Market research & Own business

Starting your own business begins with conducting market research on your industry, target audience, and competition. This research will help you determine whether your business has a chance of success and whether you need to make any changes to your product, service, or business plan.

Even if you have been in business for a while, market research can be a good investment. It ensures that you are well prepared when you enter into discussions with investors, producers, or retailers, for example.

The article below has been posted on the De Ondernemer website.

"There are two types of start-ups. If you're working from your attic room, market research is probably not cost-effective.

But if you've been developing your product or service for six months and need to invest in your business, you'd better do everything you can to ensure that your investment will pay off. External investors often also require market research."

Michael Petit, Marketing Manager Markteffect

For start-up entrepreneurs, it is particularly important to explore the industry, their own potential, future customers, and the competition through market research. Entrepreneurs who have been in business for some time can also benefit greatly from customer satisfaction surveys and image surveys, for example. With the help of expert Michael Petit, we list the different types of market research.

5 steps for market research

- Industry research: What is happening in the sector?

- Customer research: How do we reach future customers?

- Competitive research: How are competitors performing?

- Conduct market research for another group?

- Making productive use of market research

1. Industry research

Who are the key players in my industry? How much revenue do these players generate? And what are the latest innovations in the sector? These are all questions you need to ask yourself before starting a new business or launching a new product or service on the market.

Industry research provides information about a company's chances of success. If many other companies in the industry are profitable, that is a good sign. You can also draw inspiration from this by asking yourself why exactly those companies are successful. Finally, industry research can help you determine whether your company adds something to the existing industry and whether you are therefore distinctive.

In addition, industry research also provides you with information about technical and practical aspects. What does the distribution network look like? What exactly needs to be invested in terms of resources and raw materials? What is the housing situation like for many companies in the industry? This is all information that you can find out by delving deeper into the sector.

Tools and methods used in industry research

A lot of data about business activities in various sectors can already be found online. For example, you can use the following sources of information:

-

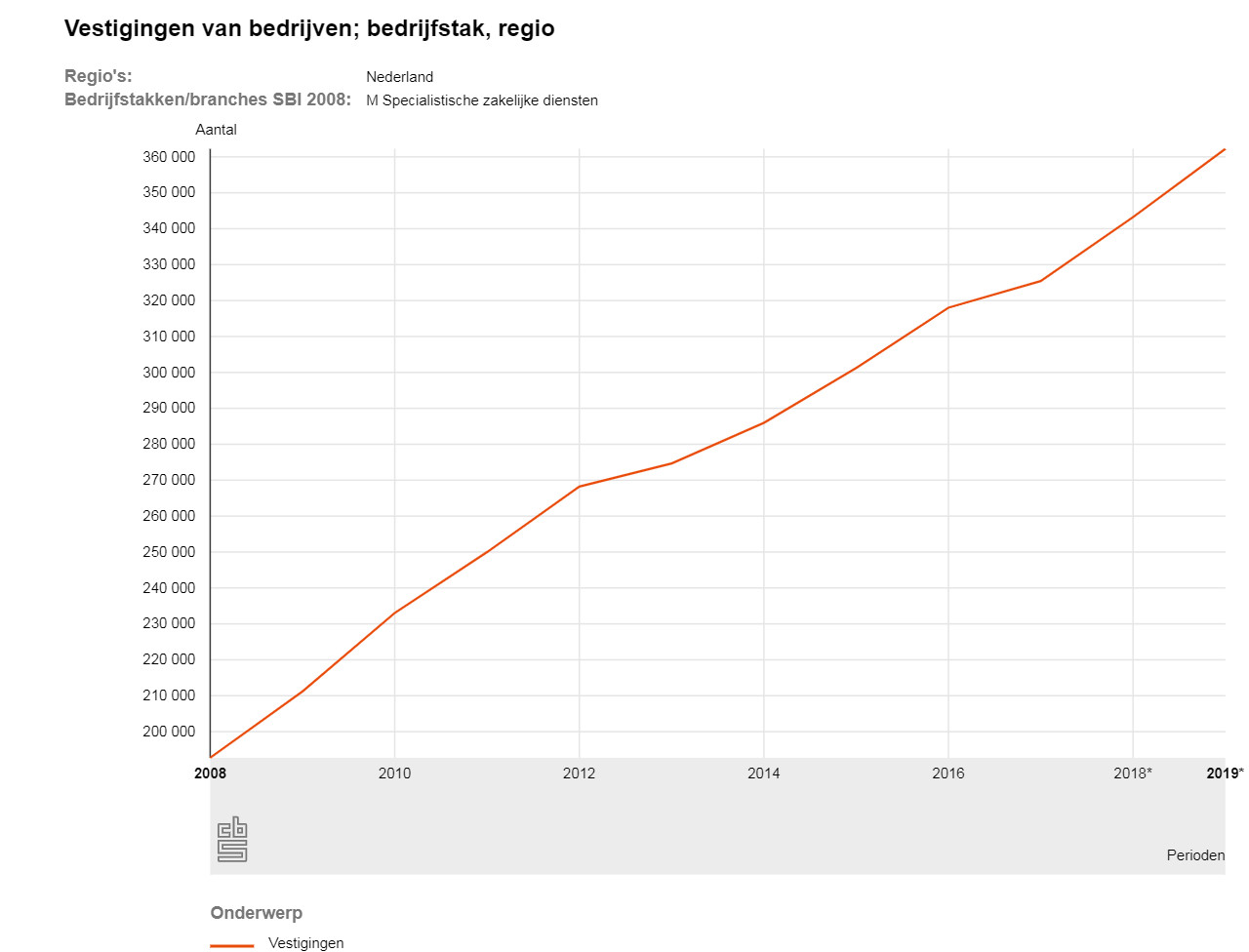

The CBS. The CBS website provides the most recent figures on Dutch business. StatLine is the CBS database, where you can also create your own graphs based on information relevant to you. In these graphs, you can, for example, select a specific sector and find out how many companies are established in this sector each year.

-

The Trade Register of the Chamber of Commerce. Through the Trade Register, you can find information about the turnover of companies in your industry and, for example, request annual accounts from certain companies.

-

The Dutch government's Business Portal. Here you will find information about the rules and regulations that apply to your industry.

Example of a graph generated on StatLine using figures from Statistics Netherlands (CBS), in this case showing the number of companies providing specialist business services.

2. Customer research

In this part of the research, you analyze your (future) customers by describing them in as much detail as possible. This will clarify who your target group is, which target group segment these customers belong to, and what you need to do to reach them. When describing your customers, you can take the following factors into account.

General characteristics of the customer

- Geography (where are customers located)

- Demographics (gender, age, beliefs, disposable income, etc.)

- Psychology (lifestyle and interests)

- Behavior (when do they use a product and how often)

It also matters whether the company focuses on consumers or other companies (business-to-business). Michael Petit of Markteffect : "For a consumer product, we map out the demographic characteristics of the target group: gender, age, education, family composition, and so on. We also look at the motives why someone would or would not want to purchase a product."

Customer journey: can the customer find me?

Another part of customer research is the so-called customer journey. This describes the orientation and selection processes that a consumer goes through before becoming your customer. What does the customer journey look like, what are the touchpoints between customer and company, and how does the customer experience them? And most importantly: what is lacking and how can you improve it?

These stages of the customer journey are discussed, among other things.

- Awareness: in the first phase, consumers must become familiar with the company, service, or product.

- Consideration: At this stage, the potential customer must consider a company, service, or product.

- Preference: the phase in which the consumer already has a preference for a provider and product.

- Choice: in the final stage, the consumer actually chooses what to buy and from whom.

According to Michael Petit of Markteffect the customer journey Markteffect an important part of market research. "If you know how the customer orientates themselves and what the importance of each contact moment is, you also know how to best tailor your marketing to this. Of course, it makes a difference whether you sell a product broadly or cater to a niche, but it is essential that you can convince the customer with the right arguments."

3. Competition investigation

This part of the market research builds on the industry research. That research should have already revealed which companies are your biggest competitors and what their approximate turnover is. A competition analysis allows you to refine your knowledge of the competition. You can describe the following characteristics, for example:

- The products and services of the competitor(s)

- The prices charged by the competitor

- The marketing and PR of the competitor(s)

- The location and formal characteristics of the competitor(s)

- The size and turnover of the competitor(s)

Once you have the formal details of your competitors, you can also analyze their strengths and weaknesses. For example, are they utilizing all of today's marketing tools? And what about the prices competitors charge for their products or services? This is information you can use to your advantage.

4. Conduct market research for further growth

If you are not a start-up but have been running your business for some time, you can also add a customer satisfaction survey, brand awareness survey, and image survey to your market research.

Customer satisfaction survey

A customer satisfaction survey can focus on a specific product or service, but also on the service within your company, for example. To investigate the satisfaction of existing customers, you can conduct a quantitative or qualitative survey. In the first type of survey, you ask as many customers as possible for their general opinion, for example via an (online) survey with closed questions and multiple-choice options. The challenge is to ask the right questions and draw up choice options that are truly relevant. You can then visualize the results in such a way that the information relevant to you is emphasized. In a qualitative survey, you ask more open-ended questions and receive extensive and detailed feedback from a smaller group of customers.

Methods for a customer satisfaction survey

- Online surveys (quantitative)

- Telephone surveys (quantitative)

- In-depth interview with customer(s) (qualitative)

- Group discussions with customers (qualitative)

- 'Customer safari' with visits to customers' homes (qualitative)

Brand awareness survey

For many companies, brand awareness is one of the most important marketing objectives. This makes sense: your product or service may be the best on the market, but if no one knows about it, you will hardly sell anything. It is useful to investigate not only the brand awareness of your own company, but also that of your competitors. It is also interesting to find out what accounts for that awareness, so that you can use your marketing and communication resources effectively to increase brand awareness. In a survey or interview, you can investigate these four forms of brand awareness:

- Top-of-mind brand awareness: which brands are spontaneously mentioned first?

- Spontaneous brand awareness: which other brands can the target group spontaneously name?

- Aided brand awareness: which brands does the target group recognize from a list?

- Substantive brand awareness: to what extent does the target group know what you offer?

Image survey

The target group chooses between you and your competitors, consciously or unconsciously taking image into account. That is what makes thorough image research so valuable. The starting points are identity (who are we?) and the desired image of the company. Surveys can help you find out how the public sees you, for example by using core values. If you want to position yourself as innovative, you can test the extent to which the target group sees the company as such. You can also ask how people view your competitors. If you score highly on certain core values compared to your competitors, this will naturally set you apart. However, it is important to first find out whether the target group has an image of such a core value. For example, what does the customer understand by 'innovative' and does this definition match yours? This is important information for the image survey.

5. Making productive use of market research

As a starting entrepreneur, all information about your industry, competition, and (future) customers gives you insight into your chances of success as an entrepreneur. After conducting market research, you will know what is going on in the industry, whether there are gaps in the market, and whether your idea is distinctive enough. Even if you already have a business and want to stay informed about current opportunities and threats in the market, market research can be useful.

Market research can also be the starting point for a SWOT analysis (strengths, weaknesses, opportunities, threats), which provides you with even more information about your company's performance. A SWOT analysis combines market research with an internal business analysis. This means that the threats and opportunities in the market are weighed against the strengths and weaknesses of a company. This gives you even better insight into the areas for improvement and challenges facing the company, which you can then use to adjust your business strategy or (annual) strategic plan.

Have market research conducted by a market research agency

Market research can, of course, also be carried out by a market research agency. Such research costs between €5,000 and €10,000 on average. Michael Petit of Markteffect : "At Markteffect , we Markteffect start-ups the option of foregoing reporting if our analysis shows that there is no interest in what a company wants to put on the market. After all, a report stating that the potential is nil is of little use, unless you want to investigate how your concept can still succeed."

Extra tip: use a Brand Tracker

Market research is often a snapshot in time, but there are also methods for conducting ongoing research, such as a 'brand tracker'. Important indicators here are brand awareness, image, and preference, possibly compared to the competition. Virtually the same research is conducted over a longer period of time to monitor developments in the most important KPIs (key performance indicators). This allows you to keep your finger on the pulse and take action as soon as necessary.

Popular topics for brand trackers

- Brand awareness: how does it develop over a certain period of time?

- Image: what is the impact of, for example, a campaign on image?

- Behavior: what does your customers' journey look like?

- Competition: how well are you performing in the market and what could be improved?

- Media behavior: what is the best way to reach your target audience?

See also

Markteffect in the media Our team Target group panels About us